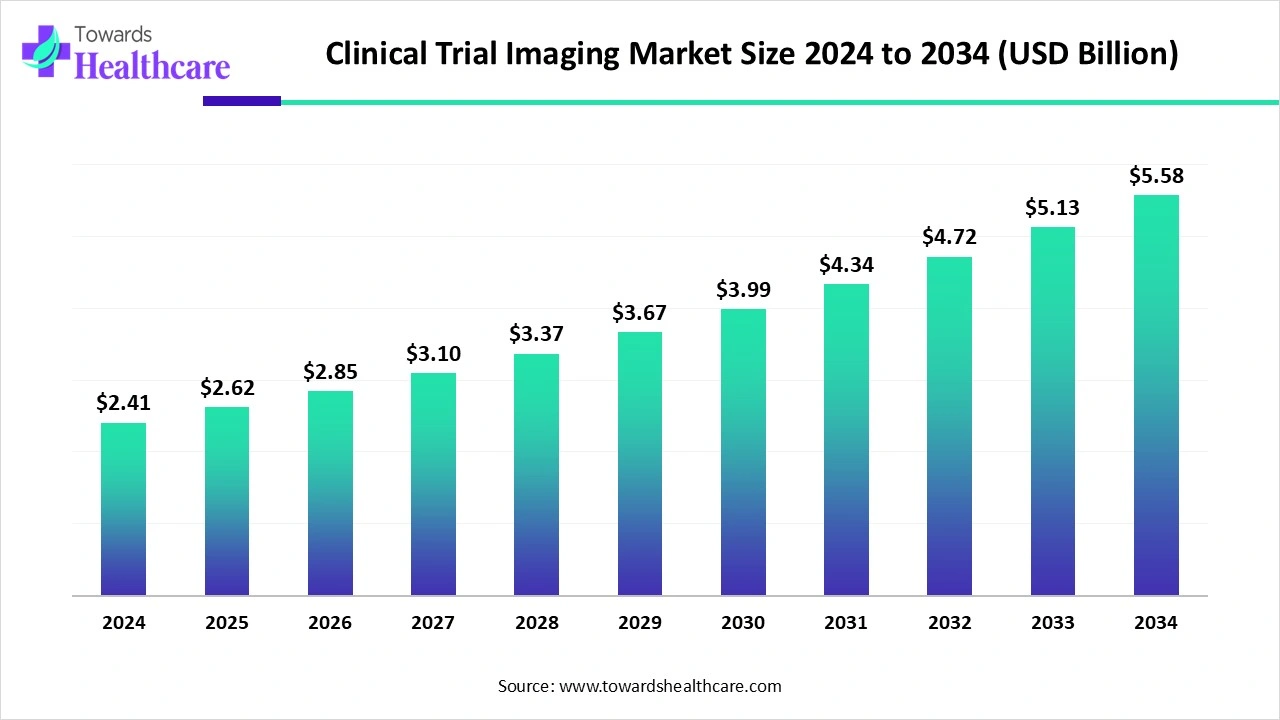

Clinical Trial Imaging Market to Reach USD 5.58 Billion by 2034, Driven by Growing Adoption of Advanced Imaging Technologies

The clinical trial imaging market size is calculated at USD 2.62 billion in 2025 and is expected to reach around USD 5.58 billion by 2034, growing at a CAGR of 8.8% for the forecasted period.

Ottawa, Oct. 30, 2025 (GLOBE NEWSWIRE) -- The global clinical trial imaging market size was valued at USD 2.41 billion in 2024 and is predicted to hit around USD 5.58 billion by 2034, rising at a 8.8% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

This market is surging as pharmaceutical and biotech companies increasingly deploy advanced imaging to improve drug development accuracy, speed regulatory approvals, and deliver better therapeutic outcomes.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6164

Key Takeaways:

- North America dominated the clinical trial imaging market with a revenue share of approximately 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By service type, the imaging core lab services segment held the largest market share of approximately 40% in 2024.

- By service type, the cloud-based imaging platforms & AI-enabled solutions segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By imaging modality, the computed tomography (CT) segment led the clinical trial imaging market with the largest revenue share of approximately 34% in 2024.

- By imaging modality, the positron emission tomography (PET) segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By therapeutic area, the oncology segment held the highest market share of approximately 45% in 2024.

- By therapeutic area, the neurology segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By end user, the pharmaceutical & biotechnology companies segment held the highest revenue shares of approximately 48% of the clinical trial imaging market in 2024.

- By end user, the contract research organizations (CROs) segment is expected to grow at the fastest CAGR in the market during the forecast period.

Market Overview:

What factors are Contributing to the Advancement of the Clinical Trial Imaging Market?

This market is surging as pharmaceutical and biotech companies increasingly deploy advanced imaging to improve drug development accuracy, speed regulatory approvals, and deliver better therapeutic outcomes. Some factors driving this growth include increasing investment in R&D by pharmaceutical and biotechnology companies, the utilization of more imaging biomarkers in clinical trials, and the move to more complex therapeutic areas such as oncology and neurology. As trials become globally based, multi-site based and data driven, imaging services, core labs, platforms and analytics, become important in demonstrating efficacy, safety and regulatory compliance.

Executive Summary Table

| Table | Scope | |

| Market Size in 2025 | USD 2.62 Billion | |

| Projected Market Size in 2034 | USD 5.58 Billion | |

| CAGR (2025 - 2034) | 8.8 | % |

| Leading Region | North America 42% | |

| Market Segmentation | By Service Type, By Therapeutic Area, By End User, By Region | |

| Top Key Players | ICON plc, Parexel International, BioTel Research (Philips), Median Technologies, Navitas Life Sciences, Bioclinica (Clario), Resonance Health Ltd., Cardiovascular Imaging Technologies, IXICO plc, Intrinsic Imaging LLC, Radiant Sage LLC, VirtualScopics Inc., WorldCare Clinical, Calyx (formerly Perceptive Informatics), Imaging Endpoints, Prism Clinical Imaging, Synarc Imaging (merged into Clario), Invicro (Konica Minolta), RadMD, ERT (merged into Clario) | |

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

What are the Primary Drivers of the Development of the Clinical Trial Imaging market?

- Development of new imaging modalities and biomarkers: Imaging mechanisms like CT, PET, MRI, and multiple-modal modalities, in conjunction or in a multimodal and objective quantitative imaging biomarkers, have rapidly gained increasing acceptance and consumption in clinical trials – particularly in oncology and neurology where imaging core-labs and analytic platforms are standard.

- Expansion of AI, cloud, centralized or hybrid trials: The rapid growth in decentralized clinical trial designs, combined with AI-enabled analysis and cloud-based imaging platforms, have increased access, feasibility, and scalability across geographies and study phases.

- Increasing Outsourcing of imaging to Contract Research Organisations (CROs): Pharmaceutical companies are increasingly focused on their core competencies, while some aspects of imaging are outsourced to specialty companies who provide operating capabilities across the complete imaging workflow and study management, with globally networked operational sites and pathways for delivery of regulatory ready data.

- Regulatory and payor demand for objective assessments: Regulators have encouraged the use of validated imaging biomarkers as surrogate endpoints, thereby requiring sponsors to adopt imaging-based approaches to best position for regulatory submissions and reimbursement of study designs and endpoints.

Key Drifts:

What Emerging Trends are Defining the Future of Clinical Trial Imaging?

Some of the main trends are the integration of artificial intelligence and machine learning into image interpretation, the increasing use of multi-modal imaging (for example PET/MRI and CT/MR combinations) as part of clinical trials, and the continuing use of decentralized and cloud-based imaging workflows that allow remote site access with standardized image acquisition and rapid image review across multi-site studies.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Significant Challenge:

High Infrastructure & Standardisation Barrier:

The greatest barrier currently impacting the clinical trial imaging ecosystem is the high costs, complexity and standardisation requirements of deploying advanced imaging modalities and datasets. Not all smaller biotech firms or emerging trial sites have the necessary infrastructure to deploy PET/CT, PET/MRI or other hybrid imaging systems; in addition, maintaining consistency of image acquisition and DICOM vs. CDISC compliance, data anonymization, and multi-site image QC poses challenges for standardisation. Reportedly, only a fraction of imaging datasets acquired as part of multi-site trials adhere to QS standards; delaying analysis, and/or submission of data to regulatory authorities.

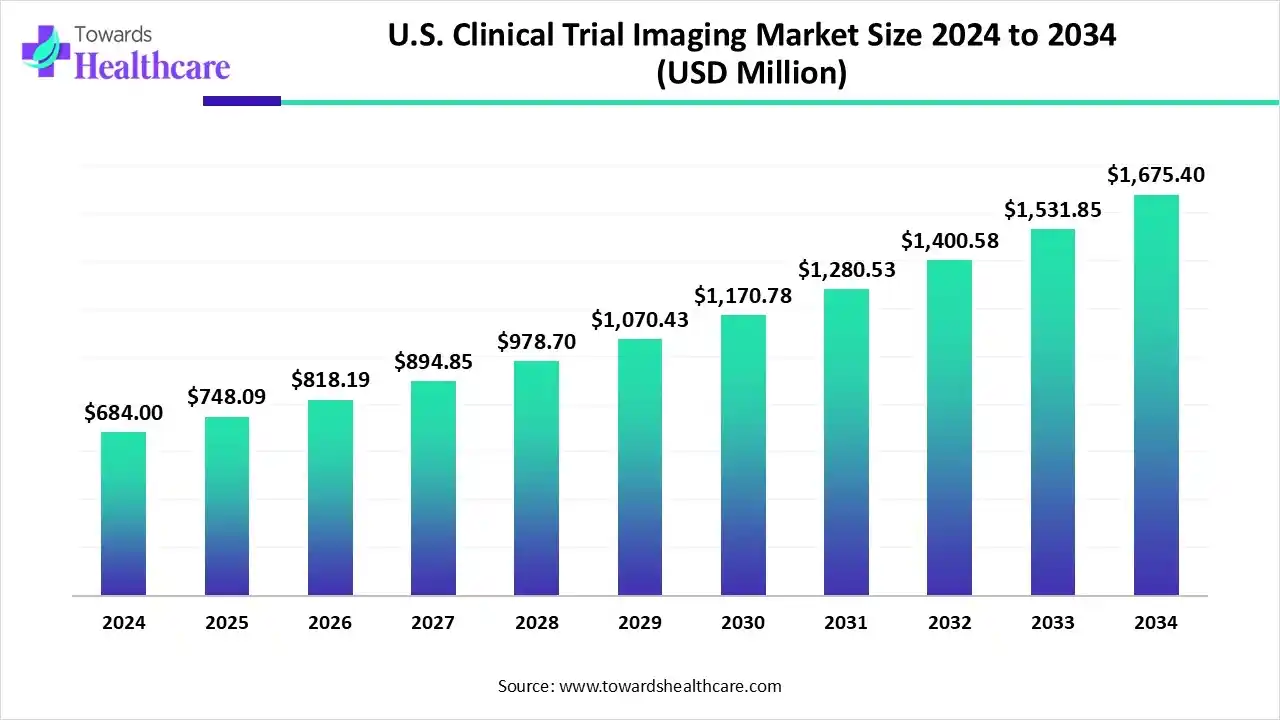

Regional Analysis: North America’s Dominance to Sustain in Forecast

North America is the leading contributor to the clinical trial imaging market and is estimated to account for the largest share of sector revenue in 2024. North America's leading position is supported by a combination of an established pharmaceutical and biotechnology ecosystem, strong levels of R&D expenditure, strong imaging infrastructure and a strong regulatory environment. A proportion of leading drug development firms and imaging core labs are based in the U.S. which, arguably, lends the region a good starting position.

U.S. Clinical Trial Imaging Market Size and Growth:

The U.S. clinical trial imaging market size marked US$ 684 million in 2024 and is forecast to experience consistent growth, reaching US$ 748.09 million in 2025 and US$ 1675.4 million by 2034 at a CAGR of 9.37%.

The U.S. clinical trial imaging market is experiencing significant growth driven by the increasing number of clinical studies, rising investment in pharmaceutical and biotechnology research, and the widespread adoption of advanced imaging modalities. The growing use of imaging biomarkers, combined with regulatory support for quantitative imaging endpoints, is enhancing trial efficiency and accuracy. Additionally, the integration of AI-driven image analysis, centralized imaging services, and precision medicine approaches is further strengthening the market, making the U.S. a global leader in clinical trial imaging innovation.

Access the U.S. clinical trial imaging market growth, trends and competitive landscape pdf @ https://www.towardshealthcare.com/checkout/6255

Further to the abundance of late-phase trials and being early to market with imaging enabled digital/cloud workflow, North America is often the first region to implement imaging innovation, which has led to a higher volume of imaging-enabled trials than the rest of the world. Lastly, the presence of regulatory, authority, and payor emphasis on the utilization of imaging related endpoints has contributed to the demand in the North American market.

It is projected that the Asia Pacific market for clinical trial imaging will grow faster than the global average with a higher CAGR. Multiple contributors to this growth include expanding pharmaceutical and biotech investment in China, India, Japan and South Korea; trial-site costs of conducting trials and patient pool diversity; faster build-out of imaging infrastructure; and decentralized/hybrid trials that use local capabilities.

Many sponsors are relocating imaging-enabled segments of their trials to Asia-Pacific for site efficiency with costs, timeliness accessing more patients and emerging capabilities at core-labs. New regulatory harmonisation in the region, as well as investments in cloud/AI solutions, enable Asia-Pacific to leapfrog startup country models. Global trials will rely more heavily on imaging, positioning Asia-Pacific as a critical hub for achieving imaging-enabled study execution and analytics.

Download the single region market report @ https://www.towardshealthcare.com/checkout/6164

Segmental Insights:

By Service Type:

In terms of therapeutic area, the imaging core lab services segment accounted for the largest share of approximately 40% of the clinical trial imaging market in 2024. Imaging core lab services encompass imaging site qualification, image acquisition support, centralised reading and adjudication, quality control and end-point reporting. The complexity of trials, especially within oncology and neurology, necessitates consistent expert imaging read-outs, motivating sponsors to rely on an experienced core lab to develop standardised imaging workflows, manage a network of global sites, ensure protocol adherence and coordinate multi-modality reads.

Within service types, the cloud-based imaging platforms and AI-enabled solutions segment is projected to register the fastest CPT during the forecast period. These imaging solutions facilitate real-time uploading of images, remote review, improved auto-QC, automated lesion detection, image biomarker quantification and centralised analytics across geographies. As research sponsors increasingly shift to more remote or hybrid trials, cloud-based imaging facilitates decentralised access to sites, faster turnaround of imaging data and standardisation of reads. AI capabilities continue to advance in maturity and automated interpretation will support faster review times, and less variability between readers, reducing costs and driving more research sponsors towards these platforms.

By Imaging Modality:

Computed tomography (CT) had the highest revenue share (about 34%) in 2024, and its significant position is due to its high speed, availability, reproducibility, and ability to be used in many therapeutic areas. Many oncology trials prefer CT to measure lesions and assess response because there are established RECIST criteria for CT. CT technology improvements make it more relevant. Additionally, many clinical trial sites have CT infrastructure in place globally, which decreases the barrier to imaging being used in a clinical trial. CT's demonstrated capabilities as a reliable imaging modality for initial screening, baseline/ follow-up imaging and endpoint quantification secure its dominant space.

The segment of positron emission tomography (PET) is projected to have the highest CAGR from 2024 to 2033. The strength of PET is molecular imaging, allowing for sensitive evaluation of tracer uptake, metabolic activity, target engagement and initial therapeutic response, especially in the area of oncology and neurology. The growth of new radiotracers, whole-body PET scanners, PET/MRI hybrids, and regulatory acceptance of PET biomarkers that are increasing demand for PET radiotracers are increasing demand for imaging analysis. In addition, drug development is increasingly addressing biologics, immunotherapies, and precision medicine; each of these therapeutic approaches increases the role of PET as a competent and reliable imaging modality.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Therapeutic Area:

In 2024, the oncology segment held the largest share of the global clinical trial imaging market, with approximately 45%. The oncology segment has this position as a result of the sheer number of oncology trials, the essential role of imaging endpoints for evaluating tumor burden, disease progression, therapeutic response and safety, and regulatory interest in imaging biomarkers for drug approval in oncology. Imaging is important in every aspect of oncology protocols, including baseline staging, assessment of therapeutic response, and long-term follow-up. Additionally, sponsors of oncology trials are using imaging in novel ways to assess more subtle changes related to the use of new classes of treatments, such as immunotherapies and targeted therapies, to determine if the patient is responding, or not responding to therapy.

The neurology segment is anticipated to have the fastest compound annual growth rate (CAGR) during the forecast period. This is due to increased research and development (R&D) activity in neurological disorders, and the essential role that imaging modalities play in assessing pathology, monitoring progression and evaluating treatment response. The increasing prevalence of neurodegenerative diseases, the demand for earlier diagnosis, and the greater use of imaging biomarkers in neurology trials are additional factors driving growth in the segment.

By End Users:

pharmaceutical and biotechnology companies were responsible for the largest share revenue as of 2024. These sponsors generate demand for imaging services as part of their drug development programmes - from proof-of-concept in early stages to pivotal registration trials, imaging data is increasingly built-in. Pharma/biotech companies will partner with imaging core labs and platform providers to outsource some of the imaging workflow, ensure readiness for regulation, and manage site networks globally. They are a clear leader in the revenue share of end-users, driven by large budgets, volume of teams that are financing advanced studies, and a demand to speed up time-to-market.

The contract research organizations (CROs) segment is expected to grow the fastest CAGR in the clinical trial imaging market. CROs increasingly act as a middle party for the Sponsors and manage imaging workflows, coordinating multiple sites, managing data and analytics. As sponsors increase the outsourcing of trial operations to CROs, CROs with imaging capabilities are benefiting by expanding sites and service offerings quickly. The pivot to cloud-based imaging platforms, AI-enabled reads, and geographical reach enables CROs to expand rapidly. Overall, the current trend in outsourcing places CROs in line for significantly high growth in imaging-services demand.

Browse More Insights of Towards Healthcare:

The global clinical trial supply and logistics market was valued at US$ 3.74 billion in 2023 and is projected to reach US$ 8.58 billion by 2034, growing at a CAGR of 7.63% from 2024 to 2034.

The clinical trial investigative site network market stood at US$ 8.36 billion in 2023 and is expected to rise to US$ 15.99 billion by 2034, registering a CAGR of 6.07% over the same period.

The clinical trial biorepository and archiving solutions market was valued at US$ 4.4 billion in 2024, increased to US$ 4.76 billion in 2025, and is projected to reach approximately US$ 9.69 billion by 2034, expanding at a CAGR of 8.21% between 2025 and 2034.

The clinical trial design market is valued at US$ 567.66 million in 2024, expected to grow to US$ 613.25 million in 2025, and projected to reach about US$ 1,228.57 million by 2034, advancing at a CAGR of 8.04% during 2025–2034.

The AI in clinical trials for drugs market is witnessing notable growth and is projected to generate significant revenue, reaching into the hundreds of millions over the forecast period from 2025 to 2034.

The cell and gene therapy clinical trials market reached US$ 10.8 billion in 2024, increased to US$ 12.47 billion in 2025, and is expected to surge to around US$ 45.31 billion by 2034, expanding at an impressive CAGR of 15.43% during 2025–2034.

The clinical trial supplies market was valued at US$ 4.9 billion in 2024, is projected to increase to US$ 5.34 billion in 2025, and is anticipated to reach around US$ 11.4 billion by 2034, growing at a CAGR of 8.87%.

The clinical trial services market is estimated at US$ 60.7 billion in 2024, rising to US$ 66.07 billion in 2025, and expected to hit approximately US$ 141.85 billion by 2034, progressing at a CAGR of 8.85% between 2025 and 2034.

The neuroscience clinical trials market is poised for substantial expansion, projected to generate hundreds of millions in revenue over the forecast period from 2025 to 2034.

The gene therapy clinical trials market is advancing rapidly across the globe, with expectations of achieving significant revenue growth, potentially reaching hundreds of millions between 2025 and 2034.

Recent Developments:

On 5 May 2025, Bayer launched its new iCRO-branded imaging core lab service, Centafore, designed to support imaging-based clinical trials and software-as-a-medical-device (SaMD) development across early research through Phase IV.

Clinical Trial Imaging Market Key Players List:

- ICON plc

- Parexel International

- BioTel Research (Philips)

- Median Technologies

- Navitas Life Sciences

- Bioclinica (Clario)

- Resonance Health Ltd.

- Cardiovascular Imaging Technologies

- IXICO plc

- Intrinsic Imaging LLC

- Radiant Sage LLC

- VirtualScopics Inc.

- WorldCare Clinical

- Calyx (formerly Perceptive Informatics)

- Imaging Endpoints

- Prism Clinical Imaging

- Synarc Imaging (merged into Clario)

- Invicro (Konica Minolta)

- RadMD

- ERT (merged into Clario)

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/checkout/6164

Segments Covered in the Report

By Service Type

- Imaging Core Lab Services

- Centralized Image Analysis

- Image Reading & Adjudication

- Regulatory Compliance Support

- Project & Data Management

- Reader Training & Certification

- Site Management & Training

- Cloud-based Imaging Platforms & AI-enabled Solutions

- Shape By Imaging Modality

- Computed Tomography (CT)

- Magnetic Resonance Imaging (MRI)

- Positron Emission Tomography (PET)

- Ultrasound

- X-ray & Other Modalities

By Therapeutic Area

- Oncology

- Neurology (Alzheimer’s, Parkinson’s, Multiple Sclerosis)

- Cardiology

- Musculoskeletal Disorders

- Others (infectious diseases, metabolic disorders)

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Medical Device Manufacturers

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6164

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.