CoinLander Bridges Defi and TradFi With $1.4 Million in Tokenized Mortgages Just 11 Weeks Post-Launch

Source: CoinLander

SINGAPORE, Jan. 15, 2026 (GLOBE NEWSWIRE) -- CoinLander, a pioneer platform tokenizing mortgage debt, has officially surpassed $1.4 million in accumulated market size. This milestone comes just 11 weeks after the platform's public launch on October 20, 2025. The rapid growth from November 13's $600,000 to current levels highlights a decisive shift in investor sentiment. As digital asset markets face continued volatility, capital is aggressively rotating toward secured, yield-bearing instruments. By enabling investors to fund mortgage loans rather than speculate on property equity, CoinLander has validated a high-demand niche for stable, debt-based returns in the crypto market.

Quality Takes the Center Stage in RWAs

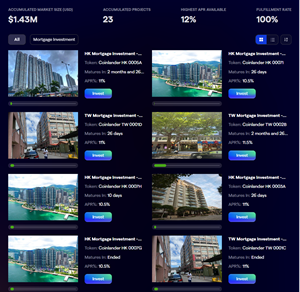

Source: RWA.xyz

CoinLander's growth trajectory mirrors a broader maturation within the digital asset space. Investors are increasingly moving away from speculative tokens in favor of Real World Assets (RWAs) that offer tangible backing. Data supports this migration. The RWA sector is now valued at $19.25 billion, having posted a 3.33% gain over the last 30 days alone. This follows a massive expansion in 2025, where the sector surged 237.14% as institutional and retail participants sought safety over speculative returns.

Adoption metrics tell a similar story. The number of unique RWA asset holders grew sevenfold last year, jumping from roughly 84,000 to nearly 588,000 by the end of 2025. CoinLander is capturing a specific segment of this expanding market: investors who want the reliability of traditional finance structures without the friction of legacy banking.

The Popularity of the 'Be the Bank' Model

A key driver of CoinLander's recent inflows is its distinct operational model. While many RWA platforms tokenize property equity—effectively making users fractional landlords dependent on property appreciation—CoinLander tokenizes the mortgage itself. This structure allows investors to "be the bank." Instead of waiting years for a property to sell to realize a profit, users earn consistent yield from the monthly interest payments made by borrowers.

This debt-focused approach solves the liquidity issues often found in real estate crowdfunding. It also taps into a market with immense depth. In November 2025, US mortgage debt stood at $13.5 trillion, representing 44% of the country's GDP. By bringing this asset class on-chain, CoinLander offers a product with a massive growth ceiling that remains uncorrelated to the price swings of Bitcoin or Ethereum.

100% Fulfillment and up to 12% APR

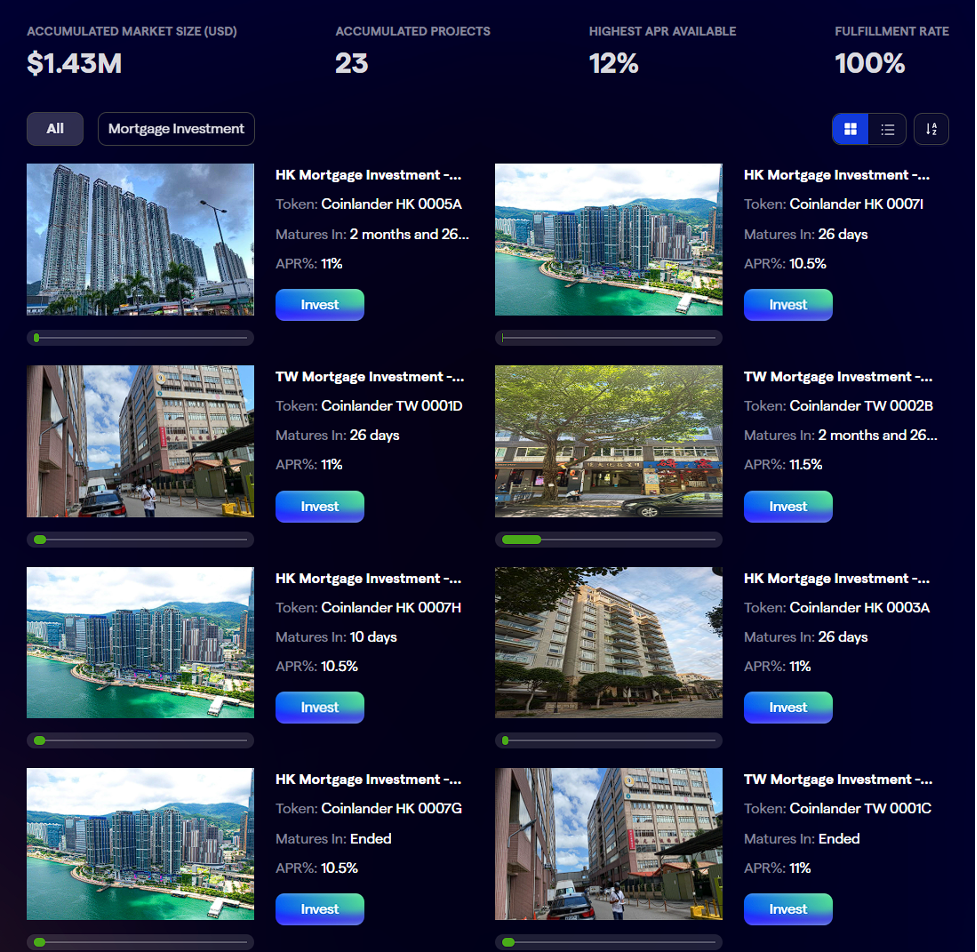

Source: CoinLander

Trust is built on performance, and CoinLander has maintained a flawless record since its October debut. The platform has successfully launched 23 mortgage projects with a 100% fulfillment rate, providing consistent returns to participants. Current pools are offering yields up to 12% APR, a figure that remains attractive to both stock market investors and DeFi natives.

"The jump to $1.4 million in such a short window proves that the market is hungry for income that makes sense," said RΞN, Founder and CEO of CoinLander. "We are seeing a convergence. Stock market investors want higher yields than bonds can offer, and crypto investors want to escape volatility without exiting the ecosystem. CoinLander solves the liquidity trap of traditional real estate by tokenizing the debt, not the building. We provide the stability of a mortgage with the speed of blockchain."

For more details about the project or further information on current mortgage pools, visit the CoinLander website and follow official updates on X, Telegram, and LinkedIn.

About CoinLander

CoinLander is a pioneering Real World Asset (RWA) platform that bridges the gap between traditional finance and the digital asset economy. It tokenizes high-quality, real-life mortgage debt, allowing users to earn predictable monthly interest backed by tangible property assets. The platform, which officially rolled out on October 20, 2025, transforms illiquid real estate debt into accessible digital investments, offering a stable alternative to the volatility of traditional crypto markets. In less than four weeks after its launch, CoinLander's Total Value Locked (TVL) surged past the $600K mark and climbed to over $1.4 million by January 5, 2026, signaling strong investor demand for stable, mortgage-backed yield in the crypto market.

Media Contact:

Team CoinLander

partner@coinlander.com

Disclaimer: This content is provided by sponsor. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c825a18-5960-4315-9559-74e476ae7dcb

https://www.globenewswire.com/NewsRoom/AttachmentNg/faf902fb-07cd-4b63-8c0e-aa0b3fd3ffce

https://www.globenewswire.com/NewsRoom/AttachmentNg/f5aa01bb-3c4e-437b-ada8-c38b619ec869

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.